Mastering Your Money: Essential Financial Tips

Congratulations on starting your own business! As a new entrepreneur, one of the most important aspects of running a successful business is managing your money wisely. Without proper financial management, even the best business idea can quickly fail. Here are some essential financial tips to help you master your money and set your business up for success.

1. Create a Budget

The first step in mastering your money as a new entrepreneur is to create a budget for your business. A budget will help you track your income and expenses, and ensure that you are not overspending. Start by listing all of your fixed expenses, such as rent, utilities, and insurance, and then estimate your variable expenses, such as marketing and supplies. Be sure to also include a buffer for unexpected expenses. Once you have a budget in place, review it regularly and make adjustments as needed.

2. Separate Personal and Business Finances

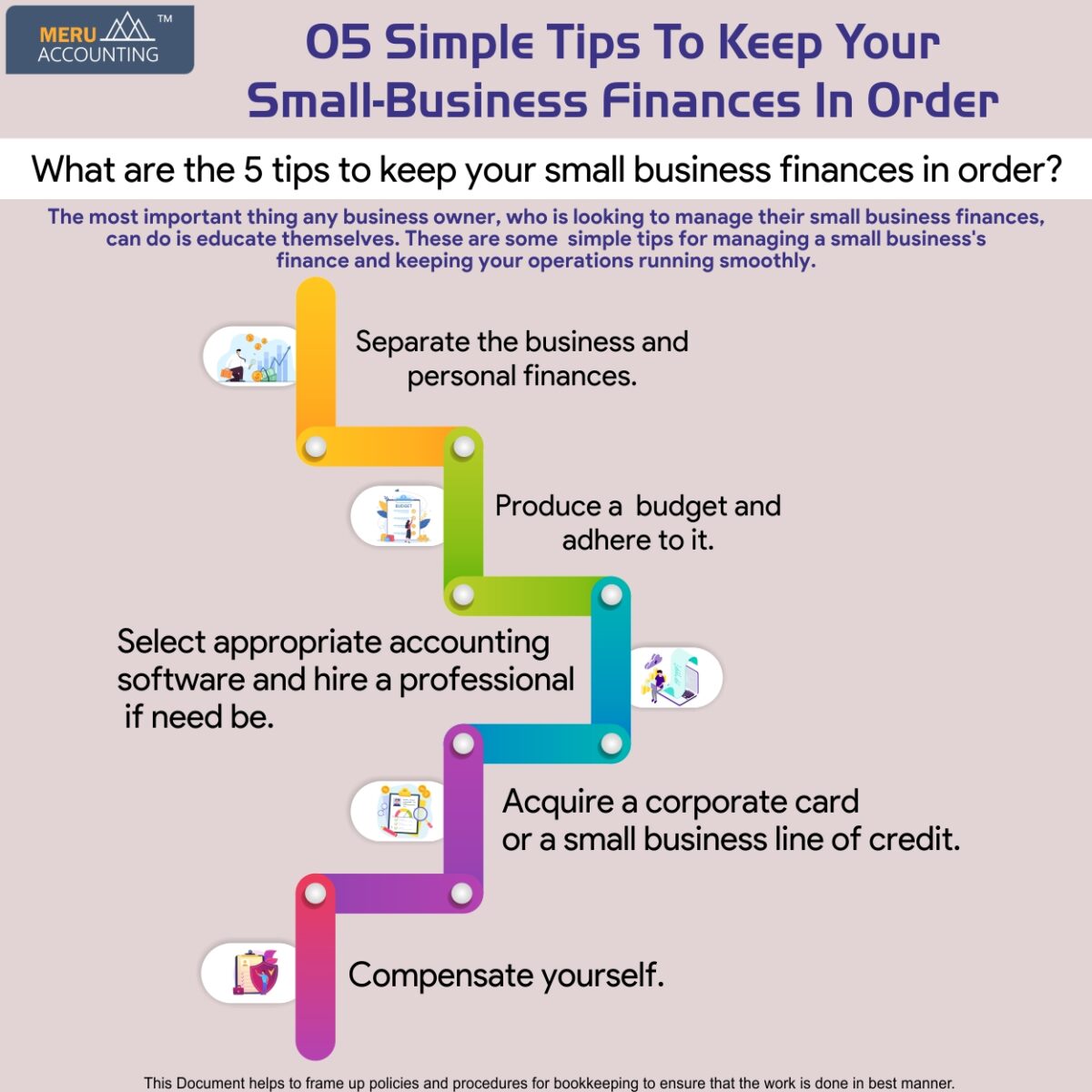

Image Source: meruaccounting.com

It is crucial to keep your personal and business finances separate. Mixing the two can not only make it difficult to track your business expenses, but it can also have legal and tax implications. Open a separate bank account for your business, and use it for all business-related transactions. This will make it easier to track your income and expenses, and ensure that you are in compliance with tax laws.

3. Track Your Expenses

In addition to creating a budget, it is important to track your expenses regularly. Keep all of your receipts and invoices organized, and enter them into a spreadsheet or accounting software. This will allow you to see where your money is going, and identify areas where you can cut costs or increase efficiency. Tracking your expenses will also make it easier to prepare your taxes at the end of the year.

4. Set Financial Goals

Setting financial goals is a great way to stay motivated and focused on growing your business. Whether your goal is to increase revenue, decrease expenses, or save for a big purchase, having a clear goal in mind will help you make better financial decisions. Break your goals down into smaller, manageable tasks, and track your progress regularly. Celebrate your successes along the way, and don’t be afraid to adjust your goals as needed.

5. Build an Emergency Fund

As a new entrepreneur, it is important to have a financial safety net in place. Building an emergency fund will give you peace of mind and protect your business in case of unexpected expenses or a slowdown in revenue. Aim to save at least three to six months’ worth of expenses in an easily accessible account. This will give you the flexibility to weather any financial storms that come your way.

6. Keep an Eye on Cash Flow

Cash flow is the lifeblood of any business, and it is essential to monitor it closely. Keep track of when your customers pay you, and when you need to pay your vendors. Make sure that you have enough cash on hand to cover your expenses, and avoid relying on credit to make ends meet. If you notice any patterns of late payments or dips in revenue, take action to address them before they become a bigger problem.

7. Invest in Your Business

Finally, don’t be afraid to invest in your business. Whether it’s upgrading your equipment, hiring a new employee, or launching a new marketing campaign, spending money on your business can help it grow and thrive. Just be sure to weigh the costs and benefits of each investment, and make informed decisions that align with your overall business goals.

By mastering your money and following these essential financial tips, you can set your new business up for success and ensure its long-term viability. Remember to stay disciplined, track your progress, and adjust your strategies as needed. With dedication and smart money management, you can achieve your financial goals and build a thriving business.

Building Your Business: Smart Money Management

Starting a new business can be an exciting and challenging endeavor. As a new entrepreneur, it’s crucial to not only focus on building your brand and attracting customers but also on managing your finances wisely. Smart money management is key to the success of any business, big or small. Here are some tips to help you navigate the world of business finance and ensure the financial health of your new venture.

First and foremost, it’s important to create a detailed business budget. This budget should outline all of your expected expenses, from overhead costs like rent and utilities to variable expenses like marketing and inventory. By creating a budget, you can better understand where your money is going and make informed decisions about how to allocate your funds. Be sure to regularly review and update your budget as your business grows and changes.

In addition to creating a budget, it’s also important to keep track of your cash flow. Cash flow is the movement of money in and out of your business, and it’s essential to monitor this closely to ensure that you have enough funds to cover your expenses. By keeping track of your cash flow, you can identify any potential issues early on and take steps to address them before they become major problems.

Another important aspect of smart money management for new entrepreneurs is to separate your personal and business finances. Mixing your personal and business finances can not only make it difficult to track your business expenses but can also have legal and tax implications. Open a separate business bank account and use it exclusively for your business finances. This will make it easier to track your business expenses and ensure that you are in compliance with any tax laws or regulations.

When it comes to managing your money wisely as a new entrepreneur, it’s also important to prioritize saving. Building up a financial cushion can help protect your business from unexpected expenses or downturns in the economy. Aim to set aside a portion of your profits each month into a business savings account. This way, you’ll have a safety net to fall back on in case of emergencies.

It’s also a good idea to explore different financing options for your business. Whether you need funding to launch your business or to expand it, there are a variety of financing options available to new entrepreneurs. From small business loans to crowdfunding, do your research and find the option that best suits your needs and financial situation. Just be sure to carefully review the terms and conditions of any financing option before committing to it.

In addition to managing your finances wisely, it’s also important to seek out advice and guidance from financial professionals. Consider working with an accountant or financial advisor who can help you develop a financial plan and make informed decisions about your business finances. They can also offer valuable insights and guidance on how to manage your money more effectively and grow your business.

By following these tips and managing your money wisely, you can set your new business up for success and ensure its long-term financial health. Building a solid financial foundation is essential for the growth and sustainability of your business, so take the time to prioritize smart money management from the start. With a little planning and foresight, you can navigate the world of business finance with confidence and achieve your entrepreneurial goals.

How to Manage Your Finances as a New Entrepreneur